HISTORY

Since its inception in 1905, the milestones of Benenson Capital Partners have had a transformative effect on the real estate industry; through signature developments, precedent creating legal action, political advocacy and powerful partnerships.

1900 - 1920s

1905

Benjamin Benenson starts Benenson Realty Company in New York City.

1926

Benjamin Benenson’s portfolio grows to include 75 buildings.

1926

Benjamin Benenson develops a retail building at 592 Fort Washington Avenue, which the company still owns today.

1927

Benjamin Benenson purchases an 84-year lease on 117-127 East 59th Street.

1927

Benjamin Benenson buys a property on 32nd Street and Broadway with a 10-year net-lease to “Horn & Hardart Company” for $96,000 a year.

1930s

1930

The Benenson family builds apartments in the Bronx at the same time as their friend David Rose.

1937

Four years after graduating from Yale University and starting his real estate career, Charlie Benenson joins his father’s firm.

1937

Benjamin and Charlie Benenson build Chelsea Gardens on 223 West 23rd Street between 7th and 8th Avenues.

1937

Benjamin Benenson dies soon after completion of the Chelsea Gardens, and his son, Charlie, takes over the Company, leading it for the next 67 years.

1938

Builds 98 – 120 Queens Boulevard in Rego Park, Queens.

1940s

1940

Charlie Benenson expands his real estate business outside New York City.

1940

The MTA begins plans to construct the 2nd Avenue subway, so Charlie buys corner properties, requiring the MTA to buy his lots.

1942

Charlie Benenson purchases the buildings at the NE corner of Third Avenue and 49th Street from the Mutual Life Insurance Company and sells the future site of Smith & Wollensky Steakhouse in 1946.

1945

Charlie Benenson leases the five-story building at 9 West 57th Street to Pepsi-Cola Company.

1946

Charlie Benenson quickly becomes one of the most prolific dealmakers in New York City, completing 16 deals in January.

1950s

1950

Charlie Benenson develops 432 East 14th Street and leases it out to the United States Postal Service whose tenancy lasts until 2014.

1958

Charlie Benenson develops the Belle View Shopping Center in Alexandria, VA.

1959

Charlie Benenson and Jack Weiler purchase 1776 Pennsylvania Avenue in Washington, DC and lease it to the United States Information Agency.

1959

Joe Albertson and Charlie Benenson complete their first sale-leaseback on a property in Portland, OR, which is followed by numerous other transactions between the two companies.

1960s

1960

Charles B. Benenson becomes the first non-family board member of the Loews Theaters, which later becomes the Loews Corporation. His membership formalizes a long association with the Tisch family.

1961

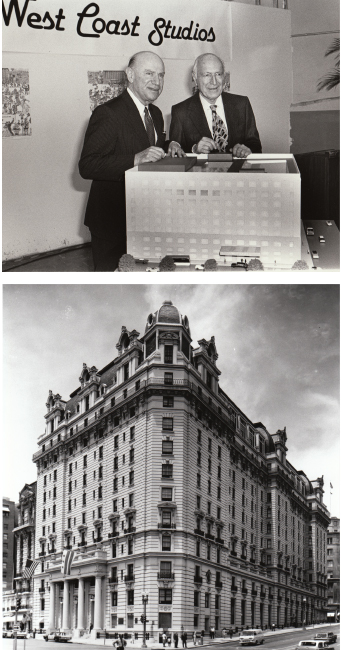

Charlie Benenson, Jack Weiler, and Robert Arnow purchase the Willard Hotel in Washington, DC.

1966

The Benenson and Tisch families purchase 787 11th Avenue, which is leased to the Packard Motor Company.

1966

Charlie Benenson and Harry Helmsley purchase the office building located at 25 West 43rd Street between 5th and 6th Avenues, which serves as The New Yorker Magazine headquarters.

1968

Benenson joins a Helmsley led syndicate that acquires the Parkchester apartment complex in the Bronx.

1969

In partnership with Laurence and Bob Tisch, Charlie Benenson buys a 555-acre parcel in Amagansett, Long Island.

1969

The Benenson and Tisch families purchase 205 acres of vacant land one mile west of the Miami airport, on which the Beacon Center mixed-used development will eventually be built.

1970s

400 Park Avenue

Connaught Towers

1600 Summer Street

1970

Responding to New York City's fiscal crisis, Charlie Benenson and Lew Rudin create the Association for a Better New York.

1970

In a joint venture with the Tisch and Rose families, Benenson Capital and its partners develop an office building localed at 1180 Avenue of the Americas.

1970

The Look Magazine office building at 488 Madison Avenue is sold.

1970

Charlie Benenson becomes one of the founding members of Yale University's Real Estate Committee.

1971

The Benenson and Tisch families acquire the office building at 400 Park Avenue.

1971

Charlie Benenson, Jack Weiler, and Robert Arnow acquire the office building at 211!l Livingston Street in Brooklyn, NY.

1972

Charlie Benenson changes the name of the Company founded by his father to Benenson Capital.

1972

Charlie Benenson and Sheldon Solow create Lincoln Center's Real Estate and Construction Council.

1973

With his name misspelled (Benenson), Charlie appears on a list of suspected Nixon White House enemies made public by John Dean in 1973 prior to his Congressional testimony.

1975

Benenson acquires a 1M + SF distribution center leased in Safeway outside of Denver, CO.

1976

Charlie Benenson and Harry Helmsley acquire the land under 575 Park Avenue, which is a co-op building called The Beekman located on Park Avenue and East 63rd Street.

1976

Charlie Benenson and Leonard Marx acquire the Cross County Shopping Center in Yonkers, NY.

1978

The Benenson and Tisch families develop the Connaught Tower, a 360-unit rental apartment building on 2nd Avenue and 54th Street.

1978

Benenson and Weiler Arnow settle the Willard Hotel lawsuit with the Pennsylvania Avenue Development Corporation (PADC), who takes title of the Willard.

1979

The office building located at 347 Madison Avenue, a Benenson Property, is sold to the Metro Transit Authority (MTA).

1979

Charlie and Ed Benenson develop a mum-tenant office building located at 1600 Summer Street in Stamford, CT. The current tenants at the property are General Electric Asset Management, AON and Phillips.

1980s

Beacon Center

1980

A sale-leaseback transaction with Safeway is completed and followed by seven similar transactions.

1982

The Connaught Tower is converted into co-ops.

1982

The Benenson and Gural families form a partnership to purchase a leasehold interest in 1560 Broadway from Actors Equity.

1983

Benenson Capital ground leases the land at 1776 Pennsylvania Avenue in Washington, DC to the World Bank, who uses the site as part of an assemblage for its new headquarters.

1985

1986

Benenson and the Tisch family form a joint venture with Armando Codina and Jeb Bush to develop the Beacon Center, a 2.SMM SF mixed-used development in Miami, FL.

1986

Four Home Depots are acquired, three in south Florida and one in Georgia.

1989

A 16 store sale-leaseback with Walmart is negotiated for the Tisch family. Benenson completes 44 subsequent transactions between Walmart and Kmart for itself or on behalf of the Tisch family.

1990s

Charlie Benenson & Richard Kessier at Met Real Estate Council Diner

The Metropolis

1990

A multi-store sale-leaseback with Fred Meyer Supermarkets in Portland, OR is completed.

1992

Benenson and Cardinal Capital Partners complete a multiproperty sale-leaseback, including a 459,424 SF distribution facility located in the City of Industry, CA.

1993

Benenson purchases the Koin Center office portfolio in Portland, OR with Louis Dreyfus Property Group.

1994

Benenson develops the Main Street Marketplace in Bellevue, WA. The property is a multi-tenant shopping center with tenants including Toys "R" Us, PetSmart, H-Mart, Office Depot and Tully's Coffee.

1995

Charlie Benenson becomes Co-Chairman Emeritus of the Metropolitan Museum of Art's Real Estate Council.

1995

A build-to-suit warehouse/manufacturing facility for a subsidiary of Asea Brown Boveri in Coral Springs, FL is developed.

1997

The Benenson and Tisch families develop the first Incredible Universe store for Tandy Corporation in Miami, FL.

1997

The Benenson and Tisch families sell 787 11th Avenue to Ford Motors in exchange for several Ford properties in Dearborn, Ml.

1997

Benenson acquires an office building located in Tigard, OR leased to KeyBank.

1997

In a joint venture with Francis Greenburger, Charlie Benenson acquires an interest in a mixed-use office and retail building in Montreal, QC, Canada.

1998

The Benenson and Tisch families sell their interest in the 2.5MM SF Beacon Center in Miami, FL.

1998

Benenson Capital and Spectrum Skanska develop the BelleFair, a master planned community in Rye Brook, NY.

1998

With the Helmsley syndicate, the Parkchester apartment complex in the Bronx is sold.

1998

Benenson joins Rose Associates to acquire 21 - 23 West Street, which is converted into luxury apartments known as Le Rivage.

1998

Benenson Capital and its partner, Neal Rodin, acquire a multi-property PNC portfolio in Philadelphia, PA. Today, the property is home to a Sofitel Hotel, a Club Quarters Hotel and a Rite Aid.

1999

Benenson Capital and Rose Associates form yet another partnership to develop The Metropolis, a luxury apartment building at the corner of Third Avenue and 44th Street.

2000s

117-127 E 59th Street

Cross County Shopping Mall

1560 Broadway

400 Park Avenue

2000

Benenson Capital forms two Joint ventures with local operating partners to develop residential and commercial properties throughout France.

2000

Benenson Capital sells the office building occupied by Sotheby's on York Avenue between 71 st and 72nd Streets.

2000

Benenson Capital negotiates a multi-store sale-leaseback with Raley's Food Stores in Las Vegas, NV.

2001

Benenson Capital acquires 2.4 acres of land on which a Marriott Renaissance hotel was developed near the Chicago O'Hare airport in Chicago, IL.

2001

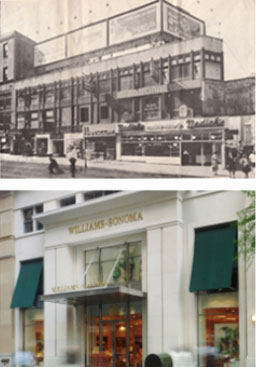

Benenson Capital acquires 117 - 127 East 59th Street, a retail condo with Pottery Barn and Williams-Sonoma. The site was previously owned by the Benenson’s’ in the 1920s.

2001

Benenson Capital purchases an office building fully leased to New York Life Insurance Company in Parsippany, NJ.

2001

Benenson and Cardinal Capital Partners complete a multi-store sale-leaseback with A&P.

2003

The Company announces the formation of Benenson Capital Partners, LLC, which is the management arm of the Benenson group of companies.

2005

The Benenson Capital Company celebrates its 100th anniversary.

2006

Benenson Capital and Marx Realty begin a S200MM renovation of Cross County Shopping Center in Yonkers, NY, including construction of a five-story parking garage, the addition of four freestanding out-parcels and seven new kiosks.

2006

A 175,000 SF residential development site on 34th Street is sold.

2007

The Koin Center office portfolio in Portland, OR is sold.

2007

An Albertsons and Big Five Sporting Goods on Wilshire Boulevard in Santa Monica, CA is acquired. Today, the Albertsons space has been re-tenanted by Bristol Farms Supermarket.

2007

The Carter Square Shopping Center in Miami, FL is purchased.

2012

Benenson buys out the Helmsley's interest in the Beekman co-op building located at 575 Park Avenue.

2012

A joint-venture is formed with the Bainbridge Companies as a co-GeneraI Partner to develop a 266-unit rental project in Raleigh, NC.

2012

The Benenson and Gural families complete a long-term lease with SL Green and Jeff Sutton for the bottom three floors and basement of 1560 Broadway. 1560 and 1552 Broadway's retail space; are combined, expanding the floor plates and creating the opportunity to expand billboard signage.

2013

Benenson Capital completes a long-term master lease at 400 Park Avenue with Waterman Interests.

2013

Benenson Capital completes the redevelopment of an old Mervyn's Department Store into a multi-tenant shopping center in Tucson, AZ.

2013

Benenson Capital sells a 459,424 SF distribution facility in the City of Industry, CA.

2010s

Rodin Square, PA

Hoyt & Horn, NYC

432 E. 13th Street

2016

Benenson Capital forms a joint venture with the Rodin Group to develop approximately 80,000 SF of retail space at Rodin Square in Philadelphia, PA.

2018

Benenson Capital and Rose Associates form a joint venture to develop a 410,000 SF luxury residential development at 210 Livingston Street in Brooklyn, NY.

2019

Benenson Capital and Mack Real Estate Group form a joint venture for a 135,000 SF mixed-use luxury residential and retail development at 432 E. 13th Street.

Present

Main Street Place, Bellevue, WA

1266 Commonwealth Avenue

Allston, MA

In partnership with Hines, Benenson Capital Partners commences the redevelopment of a 6.8-acre site in the growing market of downtown Bellevue which is soon to become a 1.5-million square foot world-renowned mixed-use development.

Benenson Capital and Hines form a joint venture to redevelop a free-standing retail structure into a mixed-use building comprising 197 luxury rentals and 12,000 square feet of ground-floor retail space. Benenson Capital has owned the investment for close to a half century.